Credit Union OK: A Comprehensive Guide

Credit unions have been gaining popularity as a financial alternative to traditional banks. One such credit union that stands out is Credit Union OK. In this article, we will delve into the various aspects of Credit Union OK, providing you with a detailed and multi-dimensional introduction.

About Credit Union OK

Credit Union OK is a not-for-profit financial cooperative that serves its members. It was established in [Year] and has since grown to become one of the leading credit unions in the region. The credit union operates with the mission of providing affordable financial services and promoting financial literacy among its members.

Membership and Eligibility

Joining Credit Union OK is straightforward. To become a member, you need to meet certain eligibility criteria. Here’s a breakdown of the requirements:

| Eligibility Criteria | Description |

|---|---|

| Residency | Must reside in the [Region/City] |

| Employment | Must be employed or retired in the [Region/City] |

| Family Members | Immediate family members of existing members are also eligible |

Once you meet the eligibility criteria, you can join Credit Union OK by opening a savings account and making a minimum deposit of [Amount].

Products and Services

Credit Union OK offers a wide range of financial products and services to cater to the diverse needs of its members. Here’s an overview:

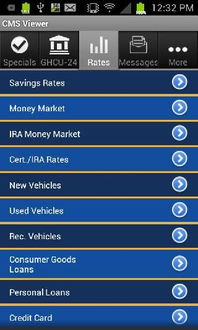

- Savings Accounts: Credit Union OK offers various savings accounts, including regular savings, money market, and certificates of deposit (CDs). These accounts come with competitive interest rates and no monthly fees.

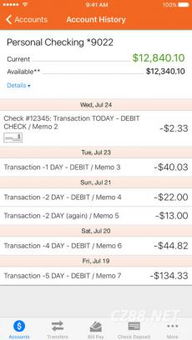

- Checking Accounts: The credit union provides different checking account options, including free checking accounts with no minimum balance requirements.

- Loans: Credit Union OK offers personal loans, auto loans, mortgages, and home equity loans. These loans come with competitive interest rates and flexible repayment terms.

- Debit Cards: Members can enjoy free debit cards with access to a network of ATMs across the country.

- Online Banking: Credit Union OK provides a user-friendly online banking platform that allows members to manage their accounts, make transfers, and pay bills online.

Benefits of Joining Credit Union OK

Joining Credit Union OK comes with several benefits, including:

- Competitive Interest Rates: Credit Union OK offers competitive interest rates on savings accounts, loans, and certificates of deposit.

- No Monthly Fees: Most of the credit union’s accounts come with no monthly fees, helping you save money.

- Personalized Service: Credit Union OK focuses on providing personalized service to its members, ensuring their financial needs are met.

- Community Involvement: The credit union actively participates in community events and initiatives, promoting financial literacy and supporting local causes.

Customer Service

Credit Union OK takes pride in its exceptional customer service. The credit union offers various channels for members to get in touch, including:

- Branch Locations: Credit Union OK has multiple branch locations across the region, where members can visit for assistance.

- Phone Support: Members can call the credit union’s customer service hotline for assistance with their accounts.

- Email Support: Members can email the credit union’s customer service team for inquiries and support.

- Online Chat: Credit Union OK offers an online chat feature on its website for real-time assistance.

Conclusion

Credit Union OK is a reliable and trustworthy financial institution that offers a wide range of products and services to meet the needs of its members. With its competitive interest rates, no monthly fees, and personalized service, Credit Union OK is an excellent choice for those looking for a financial alternative to traditional banks.