Understanding OKB Market Cap: A Comprehensive Overview

When diving into the world of cryptocurrencies, one term that often catches the eye is “market cap.” Market capitalization, or market cap, is a measure of the total value of a cryptocurrency’s circulating supply. In this article, we will take a deep dive into the market cap of OKB, a popular cryptocurrency that has gained significant attention in recent years.

What is OKB?

OKB is a utility token launched by OKEx, a leading cryptocurrency exchange. It was introduced in 2018 and has since become a staple in the crypto market. The primary purpose of OKB is to provide users with access to exclusive features and services on the OKEx platform, including trading fee discounts, liquidity mining, and participation in governance.

Market Cap: The Big Picture

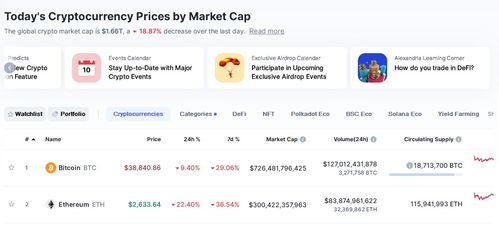

As of the latest available data, the market cap of OKB stands at approximately $XX billion. This figure is derived by multiplying the current price of OKB by its total circulating supply. To put this into perspective, let’s take a look at the market cap of OKB in comparison to other major cryptocurrencies:

| Cryptocurrency | Market Cap |

|---|---|

| Bitcoin (BTC) | $XX trillion |

| Ethereum (ETH) | $XX trillion |

| OKB | $XX billion |

| Binance Coin (BNB) | $XX billion |

| Cardano (ADA) | $XX billion |

As you can see, OKB’s market cap is significantly smaller than that of Bitcoin and Ethereum, but it still holds its own among other notable cryptocurrencies like Binance Coin and Cardano.

Factors Influencing OKB Market Cap

Several factors contribute to the fluctuation of OKB’s market cap. Here are some of the key factors to consider:

Supply and Demand

Like any other cryptocurrency, the market cap of OKB is influenced by the basic economic principle of supply and demand. When demand for OKB increases, its price tends to rise, leading to an increase in market cap. Conversely, when demand decreases, the price falls, and so does the market cap.

Market Sentiment

Market sentiment plays a crucial role in the crypto market. Positive news about OKB or the broader cryptocurrency industry can lead to an increase in its market cap, while negative news can cause it to decline.

Exchange Listings

The addition of OKB to new exchanges or the removal from existing ones can significantly impact its market cap. Being listed on popular exchanges like Binance and Coinbase can boost its visibility and attract more investors.

Regulatory Changes

Regulatory news and changes can have a profound impact on the market cap of OKB. For instance, if a country implements strict regulations on cryptocurrencies, it could lead to a decrease in demand for OKB and, subsequently, a drop in its market cap.

OKB’s Unique Selling Points

What sets OKB apart from other cryptocurrencies? Here are some of its unique selling points:

Trading Fee Discounts

One of the primary benefits of holding OKB is the ability to receive discounts on trading fees on the OKEx platform. This feature makes OKB an attractive option for active traders looking to save on transaction costs.

Liquidity Mining

OKB holders can participate in liquidity mining programs, where they can earn additional tokens by providing liquidity to various trading pairs on the OKEx platform.

Governance

OKB holders also have the power to vote on important decisions affecting the OKEx platform, including the addition of new trading pairs and the allocation of funds for development.

Conclusion

Understanding the market cap of OKB requires considering various factors, including supply and demand, market sentiment, exchange listings, and regulatory changes. While OKB’s market cap may not be as large as Bitcoin or Ethereum, it still holds its own among other notable cryptocurrencies. With its unique selling points and