OK Credit Union: A Comprehensive Guide

Are you looking for a financial institution that offers more than just traditional banking services? Look no further than OK Credit Union. This financial cooperative is dedicated to providing its members with a wide range of financial products and services tailored to meet their unique needs. In this article, we will delve into the various aspects of OK Credit Union, including its history, membership benefits, financial products, and community involvement.

History and Background

OK Credit Union was founded in [Year] with the mission of offering its members a place to save and borrow money responsibly. The credit union operates on a not-for-profit basis, which means any profits are returned to the members in the form of lower loan rates, higher savings rates, and reduced fees.

Membership Benefits

Joining OK Credit Union comes with a host of benefits that can help you manage your finances more effectively. Here are some of the key benefits you can expect:

-

Competitive interest rates on savings and loans

-

Lower fees compared to traditional banks

-

Access to a wide range of financial products and services

-

Personalized customer service from dedicated professionals

-

Opportunities to participate in community events and programs

Financial Products and Services

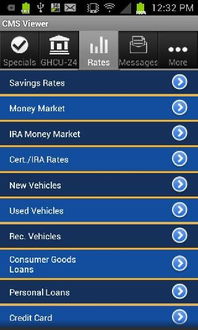

OK Credit Union offers a comprehensive suite of financial products and services designed to help you achieve your financial goals. Here’s a breakdown of some of the key offerings:

Savings Accounts

OK Credit Union offers various savings accounts to suit your needs, including:

-

Regular Savings Account: A basic savings account with no minimum balance requirement

-

Money Market Account: A higher-yielding account with limited check writing privileges

-

IRA Savings Account: A tax-advantaged account for retirement savings

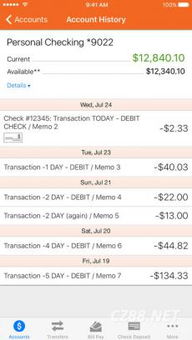

Checking Accounts

OK Credit Union offers several checking account options, including:

-

Free Checking Account: A no-fee account with no minimum balance requirement

-

Student Checking Account: A checking account designed for students with no minimum balance requirement

-

Business Checking Account: A checking account tailored to meet the needs of small businesses

Loans

OK Credit Union offers a variety of loans to help you finance your needs, including:

-

Personal Loans: Unsecured loans for various personal expenses

-

Auto Loans: Loans for purchasing a new or used vehicle

-

Home Equity Loans: Loans that use the equity in your home as collateral

Investment and Retirement Services

OK Credit Union offers investment and retirement services through its partner, [Investment Partner Name]. These services include:

-

Retirement planning and investment advice

-

401(k) and IRA rollovers

-

Stock and bond investments

Community Involvement

OK Credit Union is committed to giving back to the community. The credit union participates in various community events and programs, including:

-

Financial literacy workshops for students and adults

-

Donations to local charities and organizations

-

Volunteer opportunities for members

Conclusion

OK Credit Union is a financial institution that stands out for its commitment to its members and the community. With a wide range of financial products and services, competitive rates, and personalized customer service, OK Credit Union is an excellent choice for anyone looking for a financial partner they can trust. Consider joining OK Credit Union and experience the difference a not-for-profit financial cooperative can make in your life.

| Financial Product | Description |

|---|---|

| Savings Accounts | Competitive interest

Website: https://laplandpostcard.com |