OK Tax Commission: A Comprehensive Guide

Are you looking to understand the intricacies of tax commissions? Look no further! The OK Tax Commission is a key player in the world of tax regulation, and in this article, we’ll delve into its various aspects, ensuring you have a thorough understanding of its operations and significance.

About OK Tax Commission

The OK Tax Commission, also known as the Oklahoma Tax Commission, is an independent state agency responsible for administering Oklahoma’s tax laws. Established in 1935, the commission plays a crucial role in ensuring compliance with state tax regulations and providing services to taxpayers.

Services Offered

The OK Tax Commission offers a wide range of services to both individuals and businesses. Here’s a breakdown of some of the key services provided:

| Service | Description |

|---|---|

| Tax Filing Assistance | Assistance with filing state income tax returns, sales tax returns, and other tax-related documents. |

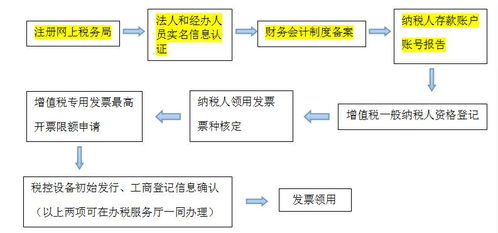

| Business Registration | Facilitating the registration of businesses in Oklahoma, including obtaining necessary permits and licenses. |

| Tax Audits | Conducting audits to ensure compliance with state tax laws and regulations. |

| Refund Processing | Processing tax refunds for individuals and businesses that have overpaid taxes. |

| Education and Outreach | Providing educational resources and conducting outreach programs to help taxpayers understand their tax obligations. |

Regulatory Functions

In addition to providing services, the OK Tax Commission plays a vital role in regulating tax practices in Oklahoma. Here are some of the key regulatory functions:

- Enforcing state tax laws and regulations

- Monitoring tax collections and ensuring accurate reporting

- Investigating tax fraud and other violations

- Collaborating with other state agencies to address tax-related issues

Impact on Taxpayers

The OK Tax Commission has a significant impact on taxpayers in Oklahoma. Here are some ways in which the commission affects taxpayers:

- Ensuring fairness and compliance in tax practices

- Providing resources and support to taxpayers to help them understand and meet their tax obligations

- Addressing tax-related concerns and resolving disputes

- Facilitating the efficient processing of tax refunds

Challenges and Solutions

Like any organization, the OK Tax Commission faces challenges in its operations. Here are some of the challenges and the solutions implemented to address them:

- Challenge: Keeping up with changing tax laws and regulations

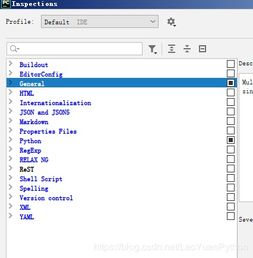

- Solution: Regularly updating resources and providing training to staff to ensure compliance with the latest tax laws

- Challenge: Handling a high volume of tax filings and inquiries

- Solution: Implementing efficient processes and utilizing technology to streamline operations

- Challenge: Addressing tax fraud and other violations

- Solution: Strengthening enforcement efforts and collaborating with other agencies to combat tax fraud

Conclusion

The OK Tax Commission plays a crucial role in administering Oklahoma’s tax laws and ensuring compliance. By providing a wide range of services, enforcing regulations, and addressing challenges, the commission helps taxpayers navigate the complexities of state taxes. Understanding the functions and impact of the OK Tax Commission is essential for anyone dealing with state tax matters in Oklahoma.